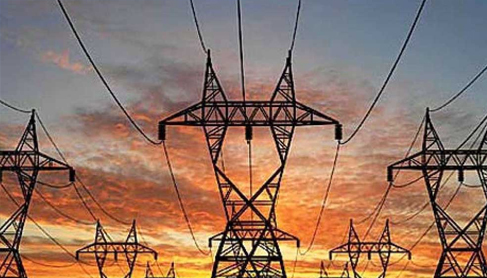

ISLAMABAD: The Ministry of Energy (Power Division) has attributed the rise in circular debt between July and November 2025 to seasonal factors that affect monthly debt flows, stressing that such increases are typically reversed by the end of the fiscal year.

In a statement, a Power Division spokesperson said that circular debt flows eased in December 2025, bringing the net increase to less than Rs80 billion for the July–December 2025 period. “It is important to note that the circular debt flow declined in December 2025, resulting in a net debt flow of less than Rs80 billion for July–December 2025,” the spokesperson said.

The official added that circular debt had declined substantially during fiscal year 2024–25, falling to Rs1.614 trillion. This reduction, he said, was achieved through improved operational efficiencies of power distribution companies (DISCOs), strengthening macroeconomic conditions, and the waiver of late payment surcharges following successful negotiations with independent power producers (IPPs).